By Adam Zierenberg

•

April 9, 2024

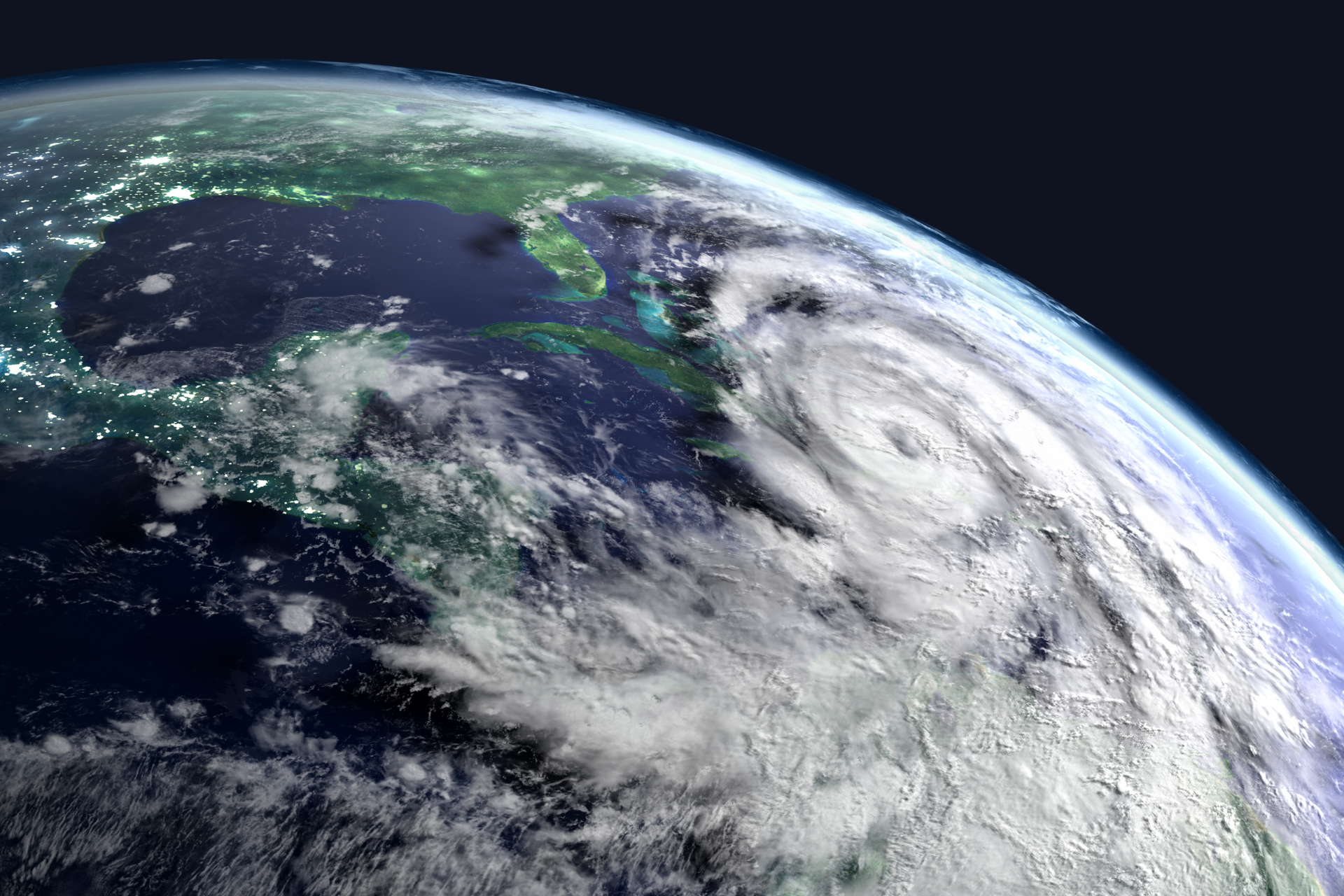

In a world where the frequency and severity of natural disasters are on the rise, the landscape of property and casualty insurance is rapidly evolving. With each passing year, hurricanes, wildfires, floods, and other extreme weather events pose greater risks to homeowners and businesses alike. As concerns about climate change mount, insurers are stepping up to the challenge, reshaping their approaches to risk assessment, coverage offerings, and policyholder education. At Synergy Insurance Advisors, we’re committed to informing consumers and promoting resilience in the face of escalating climate-related risks. Rising Frequency and Severity of Natural Disasters The statistics paint a stark picture: premiums for homeowners insurance rose by an average of 21% between May 2022 and May 2023, according to data from online insurance marketplace Policygenius. While factors such as higher construction costs contribute to this increase, climate change stands out as a major driver. The heightened likelihood of natural disasters translates to higher risks and greater financial burdens for insurers and policyholders alike. Consider the impact of Hurricane Idalia in August 2023, which caused approximately $2.5 billion in damages, according to NOAA. In the west, wildfires continue to ravage landscapes, with over 275,000 acres burned in California alone by September 2023. These events not only devastate communities but also strain the resources of insurers, leading to increased premiums and tighter coverage restrictions. In response to these challenges, insurers are investing in advanced modeling and underwriting data analytics to better assess climate-related risks. Insurers are also exploring innovative solutions such as parametric insurance, which pays out based on predefined weather conditions rather than traditional damage assessments. These efforts aim to improve the accuracy of risk assessments and pricing models in a rapidly changing climate. Innovations in Risk Assessment To tackle the evolving risks linked with climate change, insurers are increasingly adopting innovative technologies and advanced data analytics. Through the utilization of satellite imagery, machine learning algorithms, and other tools, insurers enhance their capacity to assess and mitigate the potential impacts of extreme weather events. These advancements in technology facilitate more precise risk modeling, enabling insurers to customize coverage offerings according to specific regions and vulnerabilities. Moreover, by integrating cloud-penetrating satellite imagery and data analytics, insurers gain a holistic understanding of risks associated with individual properties, providing crucial insights into hazard exposure and property vulnerability, thereby ensuring accurate risk assessment. Policyholder Education and Risk Management To better protect their properties against climate-related risks, homeowners and businesses can take proactive steps and utilize resources provided by insurers: Invest in Insurance Coverage : Homeowners can hedge against the financial risks of climate change by purchasing insurance policies that cover damage from extreme weather events. Businesses should also ensure they have adequate insurance coverage to protect against potential losses due to climate-related damages. Implement Resilient Building Practices : Consider investing in home improvements that increase resilience to climate-related hazards. This may include installing storm shutters, reinforcing roofs, or retrofitting buildings to withstand severe weather conditions. Stay Informed : Stay updated on climate-related risks and hazards in your area by monitoring weather forecasts, climate projections, and local advisories. Insurers often provide resources and guidance on risk mitigation strategies tailored to specific regions. As insurers, we also play a role in promoting resilience and preparedness and should focus on: Fortifying Risk Assessment : Continuously assess and evaluate climate-related risks to better understand and anticipate potential exposures. This may involve leveraging advanced data analytics and modeling techniques to enhance risk assessment capabilities. Holistic Risk Management : Integrate climate-related risks as part of the broader enterprise risk management framework. Adopt a holistic approach toward managing risks by considering interconnected factors such as environmental, social, and governance (ESG) criteria. Demonstrate Climate Readiness : Take proactive steps to demonstrate climate readiness to regulators, analysts, and customers. This may include transparent reporting on climate-related initiatives, disclosing climate-related risks in financial statements, and actively engaging with stakeholders on climate resilience efforts. Regulatory Implications and Industry Initiatives The response to climate change extends beyond individual insurers to encompass government regulations and industry-wide initiatives. Regulatory frameworks are evolving to address the growing threat of extreme weather events, influencing underwriting practices and pricing strategies within the property and casualty insurance sector. Take Action to Protect Your Property As the impacts of climate change continue to intensify, it's essential for homeowners and businesses to take proactive steps to protect their properties and assets. By partnering with Synergy Insurance Advisors, individuals can gain access to tailored solutions and expert guidance to navigate the challenges ahead. Whether you're looking to assess your current coverage, implement risk mitigation measures, or stay informed about emerging threats, now is the time to take action. Schedule a consultation with us to explore how you can strengthen your resilience in the face of increasing climate-related risks. Together, we can build a more resilient future for all.