How Market Trends Impact Your Insurance Rates

Rising Premiums: A Nationwide Trend

Homeowners across the country are experiencing noticeable increases in their insurance premiums. According to an April 2024 article in the Insurance Journal, the national average for homeowners insurance is expected to hit a record $2,522 by the end of the year, marking a 6% rise from late 2023. This increase follows a substantial 20% surge over the previous two years. Such adjustments are a response to multiple factors, including inflation, increased construction costs, and a higher frequency of claims.

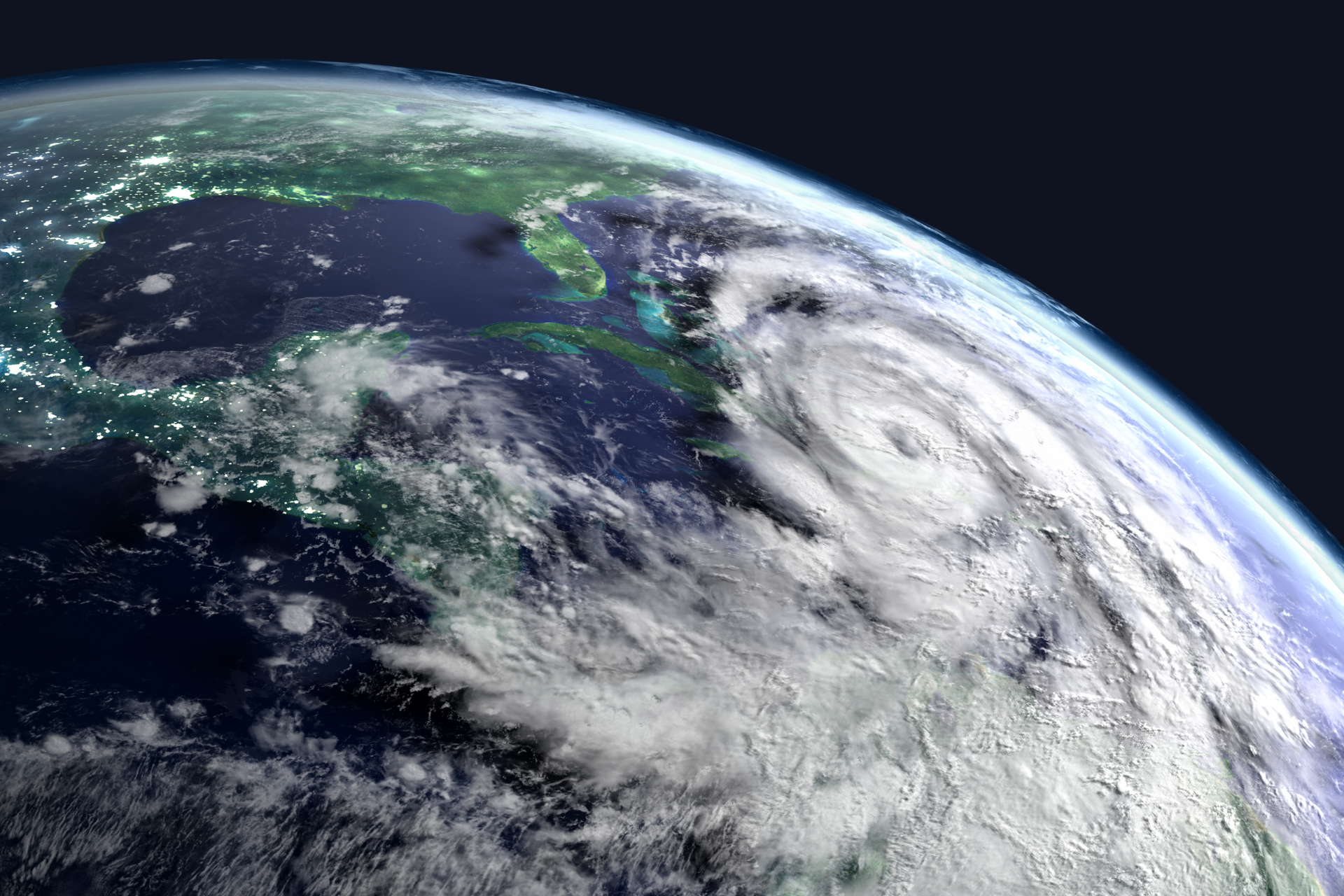

Impact of Weather on Premiums

Weather-related events significantly influence premium rates, especially in states prone to natural disasters. States like California and Florida, for example, are witnessing sharper premium hikes. This is due to the increasing frequency and severity of events such as hurricanes, wildfires, and floods. The upcoming hurricane season is predicted to be particularly intense, with up to 25 named storms anticipated. As these natural disasters become more common, insurance companies are adjusting their rates to mitigate the increased risk.

Market Withdrawals and State-Operated Insurers

The escalation in catastrophic events has led some insurers to withdraw coverage from high-risk areas. States like California and Florida have seen major insurers reduce their presence, leaving a larger volume of risk to be managed by state-operated "insurers of last resort." This shift not only affects homeowners directly by reducing the availability of private insurance options but also impacts state budgets and resources.

Climbing Auto Insurance Rates

Auto insurance is not immune to the trend of rising premiums. The nationwide average annual cost for full-coverage auto insurance is now $2,543. Between 2014 and 2023, auto insurance rates surged by 63.8%. Contributing factors include inflation, ongoing supply chain disruptions, and the rising costs associated with car repairs and medical expenses from accidents.

For those in the market for a new vehicle, choosing models with lower insurance rates can be beneficial. The Honda CR-V and Subaru Outback, for example, are among the most cost-effective vehicles to insure, with an average annual rate of $1,723.

Personalized Factors Influencing Rates

It’s important to remember that many personal factors influence insurance rates. These include your driving history, credit score, coverage choices, deductible levels, and the specific model of your car. Keeping a clean driving record and maintaining good credit can help mitigate some of the cost increases. Additionally, regularly reviewing your policy and comparing rates can ensure you are getting the best possible coverage for your needs.

Understanding the factors behind rate adjustments in the insurance industry can help you make informed decisions about your coverage. Whether it's homeowners or auto insurance, staying informed and proactive is key.

Schedule a Consultation with Synergy Insurance Advisors to review your current policies and explore how we can help you navigate these changes effectively.